As a long-term investor, you’re always thinking about what factors drive your investment returns. Unfortunately, many investors focus on things that cause short

How much do you really know about retirement benefits?

If you’re like most Americans, it’s not that much. In fact, most of us have fairly poor “retirement

For business owners, building a successful enterprise is often the culmination of years of hard work, dedication, and sacrifice. But as your business evolves

Read More

First, let’s start by uncovering the most common mistake in estate planning…

Surprisingly, this frequently made mistake might already be on your doorstep. A

How do you feel about the state of the economy? In more contemporary terms, what are your "vibes" telling you?

Read More

As a business owner, the journey to financial success can be both exhilarating and challenging. From managing cash flow to planning for growth, the financial

Read More

A power of attorney (POA) can grant you certain authority and specific responsibilities. While the extent and limitations of POAs can vary based on many factors

Read More

How many years will your retirement last?

What are the chances you’ll live past 90?

Most of us answer those questions wrong because we don’t have strong longe

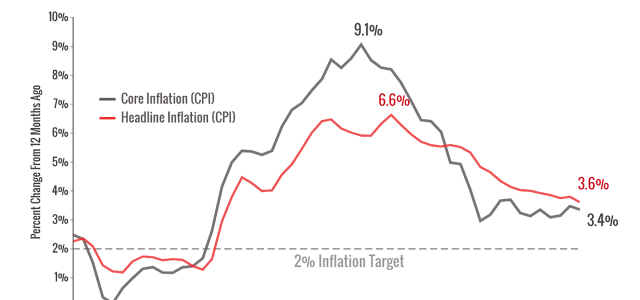

After months of simmering inflation reports, it looks like inflation finally eased slightly in April. Are prices stabilizing? Can we breathe a sigh of relief

Read More

With healthcare costs often resembling an unpredictable market, and long-term care expenses looming, the post-work years require careful financial planning

Read More

Believe it or not social media scams have been picking more pockets than any other scam today––including phone call and text fraud.1

There have been more than

Markets have been very volatile lately. What’s going on? Let’s take a quick look at the factors that are influencing markets right now.

Read More